Reports / Admin Reports / Daily Transactions Reconciliation

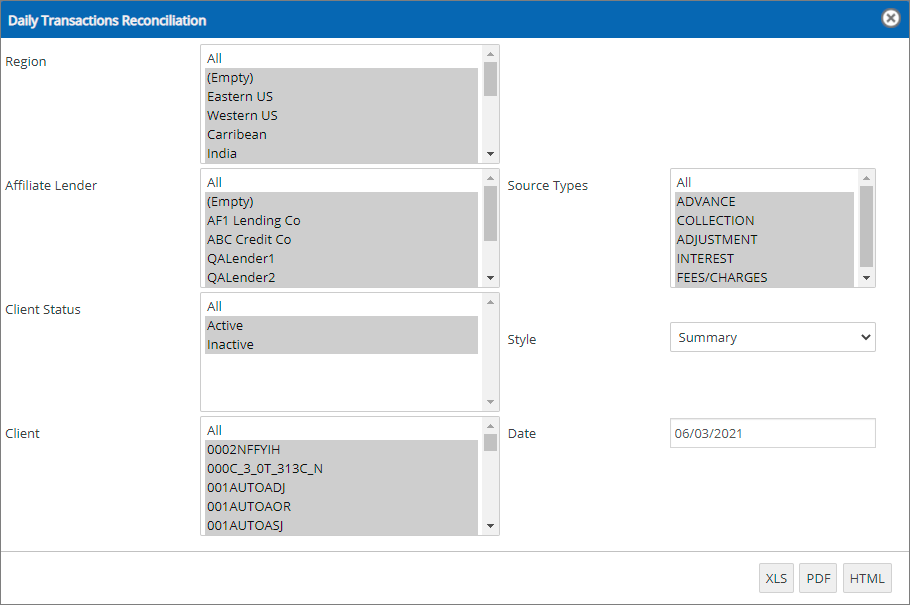

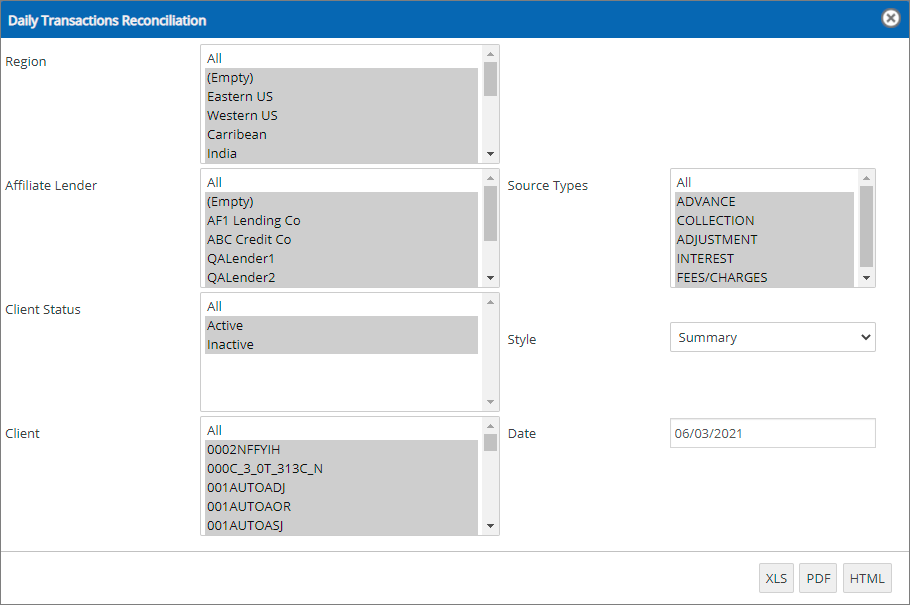

Daily Transactions Reconciliation

The Daily Transactions Reconciliation report shows a summary of all the daily transactions reconciliation cash collection on your sales, fund Request, advances and loan activity transactions.

Navigation: Menu → Reports → Admin Reports → Daily Transactions Reconciliation

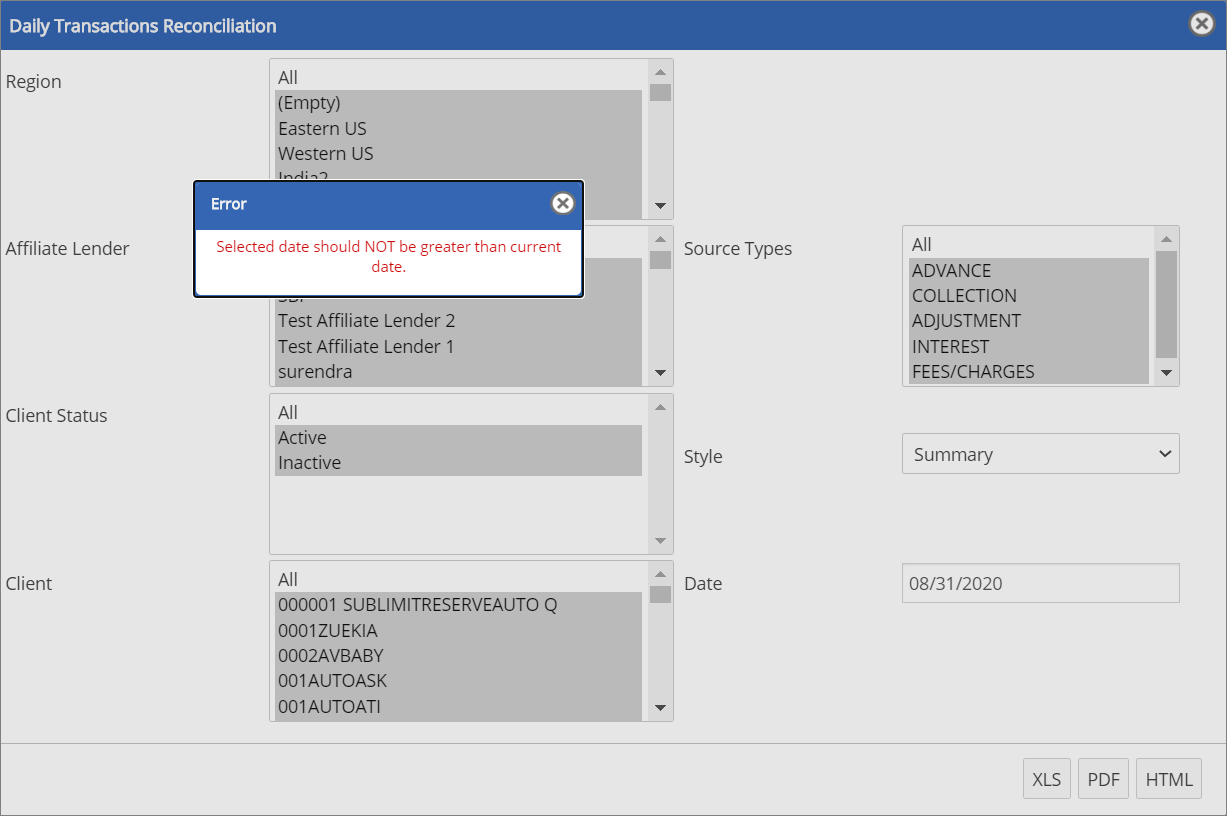

Refer to the screenshot:

Fields and Descriptions

|

Fields |

Descriptions |

|

Region |

Specifies the region name. |

|

Affiliate Lender |

Specifies the affiliate lender name. |

|

Client Status |

Specifies the status of the client such as Active or Inactive. |

|

Client |

Specifies the client name. |

|

Source Types |

Specifies the source types such as ADVANCE, COLLECTION, ADJUSTMENT, INTEREST and FEES/CHARGES. |

|

Style |

Specifies the report styles such as Summary and Detailed. |

|

Date |

Allows to select the date to generate the report. |

To generate the Daily Transactions Reconciliation report, perform these steps:

1. Go to Reports → Admin Reports → Daily Transactions Reconciliation Report. A Daily Transactions Reconciliation Report dialog box appears.

2. In the Region field, select the region name from the drop-down list to extract the report for the clients whose client name is associated with the specific region or select Empty to extract the report for the clients whose client name is not associated with any region.

3. In the Affiliate Lender field, select the affiliate lender name from the drop-down list to extract the report for the clients whose client name is associated with the specific affiliate lender or select Empty to extract the report for the clients whose client name is not associated with any affiliate lender.

4. In the Client Status field, select the client status such as Active or Inactive or All.

5. In the Client field, select one or more client name(s) from the drop-down list or select ALL to extract reports for all clients.

By default, the system auto-selects the client names which were associated with the selected Region and Affiliate Lender names.

By default, the system auto-selects the client names which were associated with the selected Region and Affiliate Lender names.

6. In the Source Types field, select the source types from the drop-down list. It includes the following:

● ADVANCE

● COLLECTION

● ADJUSTMENT

● INTEREST

● FEES/CHARGES

7. In the Style field, select the style such as Summary or Detailed, from the drop-down list.

8. In the Date field, select the date on which you wish to generate the report.

The default date would be the current date. The selected date should be less than the current date.

The default date would be the current date. The selected date should be less than the current date.

9. Click XLS or PDF or HTML to download the respective output formats. A pop-up message appears.

10. Click Save if you want to save the report. (or)

11. Click Open if you want to open the report. The report is extracted.

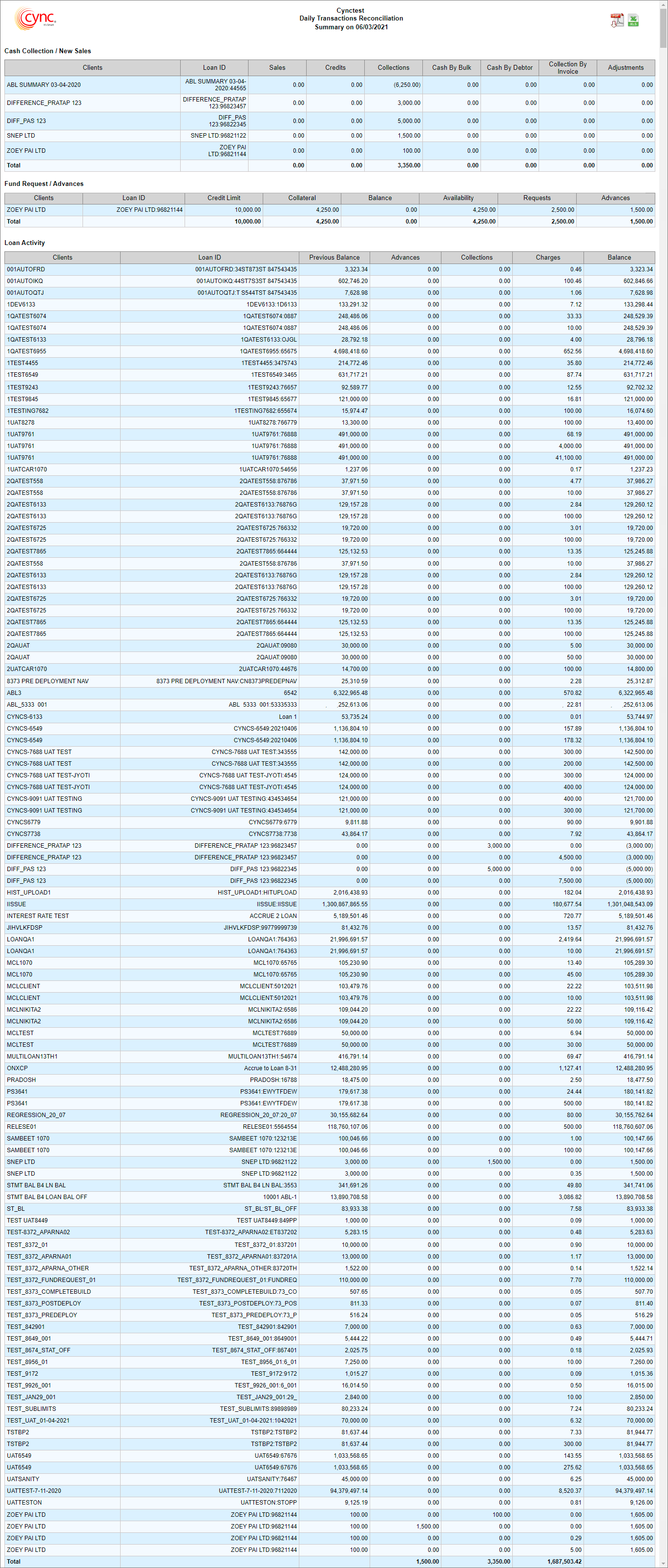

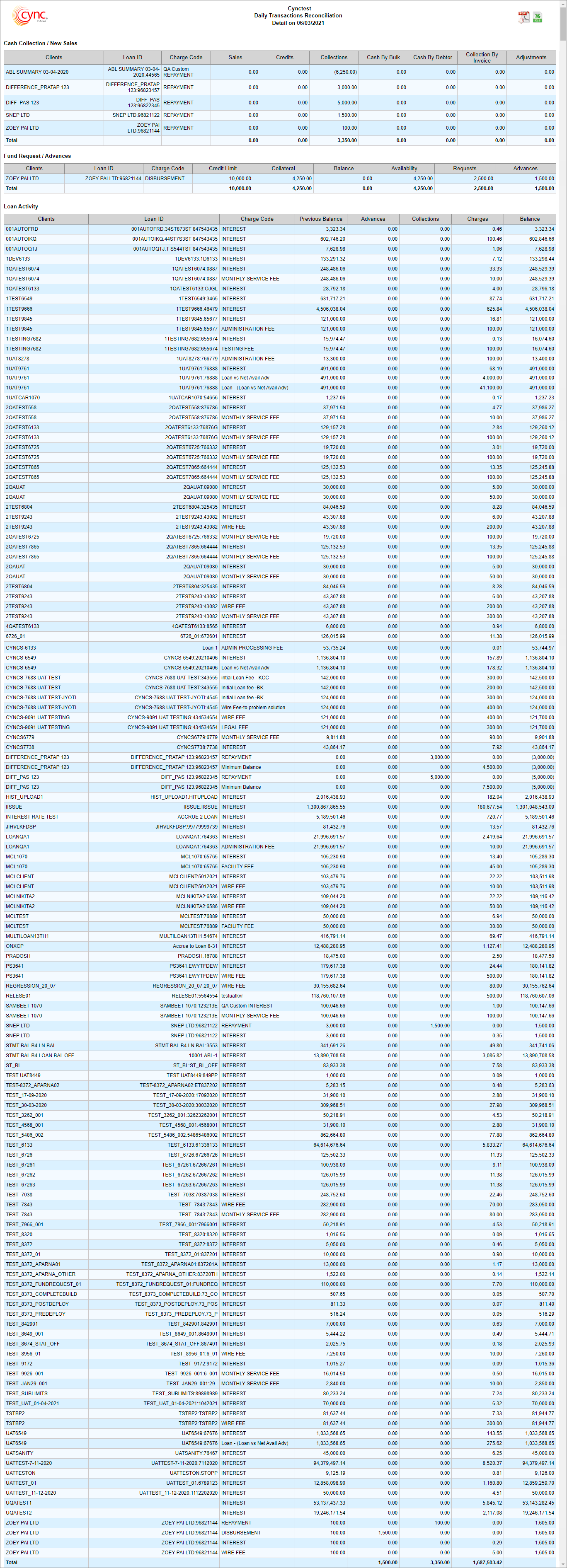

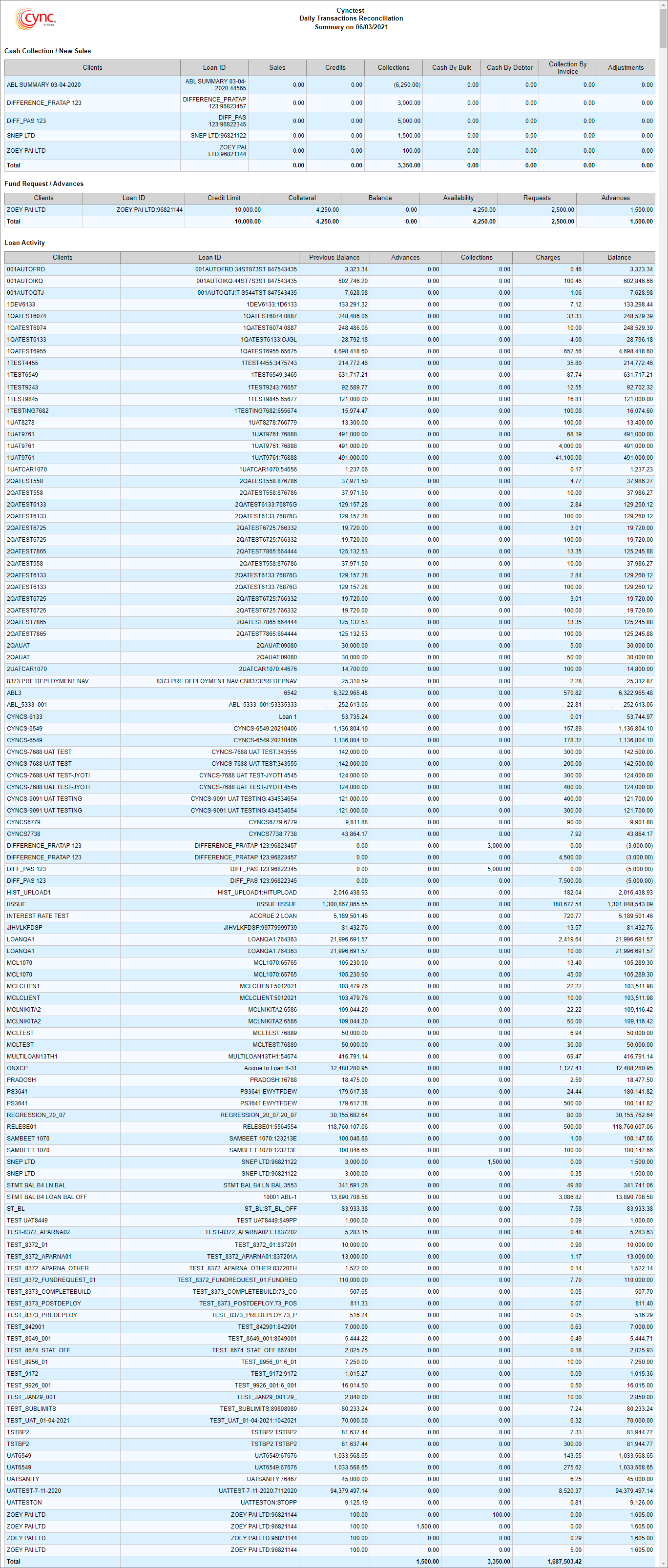

Refer to the screenshots:

Summary View Report:

Detailed View Report:

The Daily Transactions Reconciliation report shows the following details:

Affiliate Lender – Specifies the affiliate lender name.

Client Status – Specifies the status of the client such as Active or Inactive.

Client – Specifies the client name.

Cash Collection/New Sales: This section is shown in the report only if the Source Types option is selected as Collection.

Clients – Displays the client name.

Loan ID – Displays the loan ID number.

Charge Code – Displays the charge code value. This field is displayed only in a detailed report.

Sales – Displays the new sales value from the Receivables Rollforward page.

Credits – Displays the value of the new credit from the Receivables Rollforward page.

Collections – Displays the new cash collected value from the Receivables Rollforward page.

Cash By Bulk – Displays the batch payment/repayment value made by bulk via Cash Application on the selected date.

Cash By Debtor – Displays the batch payment/repayment value made by the debtor via Cash Application on the selected date.

Collection By Invoice – Displays the batch payment/repayment value made by invoice via Cash Application on the selected date.

Adjustments – Displays the adjustment value made while doing payment/repayment via Cash Application on the selected date.

Fund Request/Advances:

Clients – Displays the client name.

Loan ID – Displays the loan ID number.

Credit Limit – Displays the credit limit value of the specific client.

Collateral – Displays the total availability value from the Fund Request page.

Balance – Displays the loan balance value from the Fund Request page.

Availability – Displays the sum of Funded Amount and Net Borrowing Base Availability value.

Requests – Displays the Fund Requested value from the BBC Review Data page.

Advances – Displays the Funded Amount value from the BBC Review Data page.

Loan Activity:

Clients – Displays the client name.

Loan ID – Displays the loan ID number.

Previous Balance – Displays the previous loan balance value.

Advances – Displays the disbursement value on the selected date from the Collateral Loans page.

Collections – Displays the repayment value on the selected date from the Collateral Loans page.

Charges – Displays the interest value from the Collateral Loans page.

Balance – Displays the outstanding balance value on the selected date from the Collateral Loans page.

The system displays the following details in the extracted report based on the options selected in the Source Types field:

The system displays Repayment and Custom Repayments in the Cash Collection/New Sales section for both ABL and NON-ABL Loans within the selected date range if the Collection option is selected in the Source Types field.

The system displays Disbursement and Custom Disbursements in the Fund Request/Advances section for both ABL and NON ABL Loans within the selected date range if the BBC is Approved and the Advance option is selected in the Source Types field.

The system displays the Interest and Custom Interest in the Loan Activity section for ABL and NON-ABL Loans within the selected date range if the Interest option is selected in the Source Types field.

If the date is selected greater than the current date while generating the daily transaction reconciliation report, then the system shows an error notification.

Refer to the screenshot:

To extract the Daily Transactions Reconciliation report in PDF format, perform these steps:

1. Click the ![]() icon in the generated Daily Transactions Reconciliation report. A popup message “Do you want to open or save Daily_Transactions_Reconciliation.pdf from cyncsoftware.com” appears.

icon in the generated Daily Transactions Reconciliation report. A popup message “Do you want to open or save Daily_Transactions_Reconciliation.pdf from cyncsoftware.com” appears.

2. Click Save if you want to save the report. (or)

3. Click Open if you want to open the report. The report is extracted in PDF format.

Refer to the screenshot:

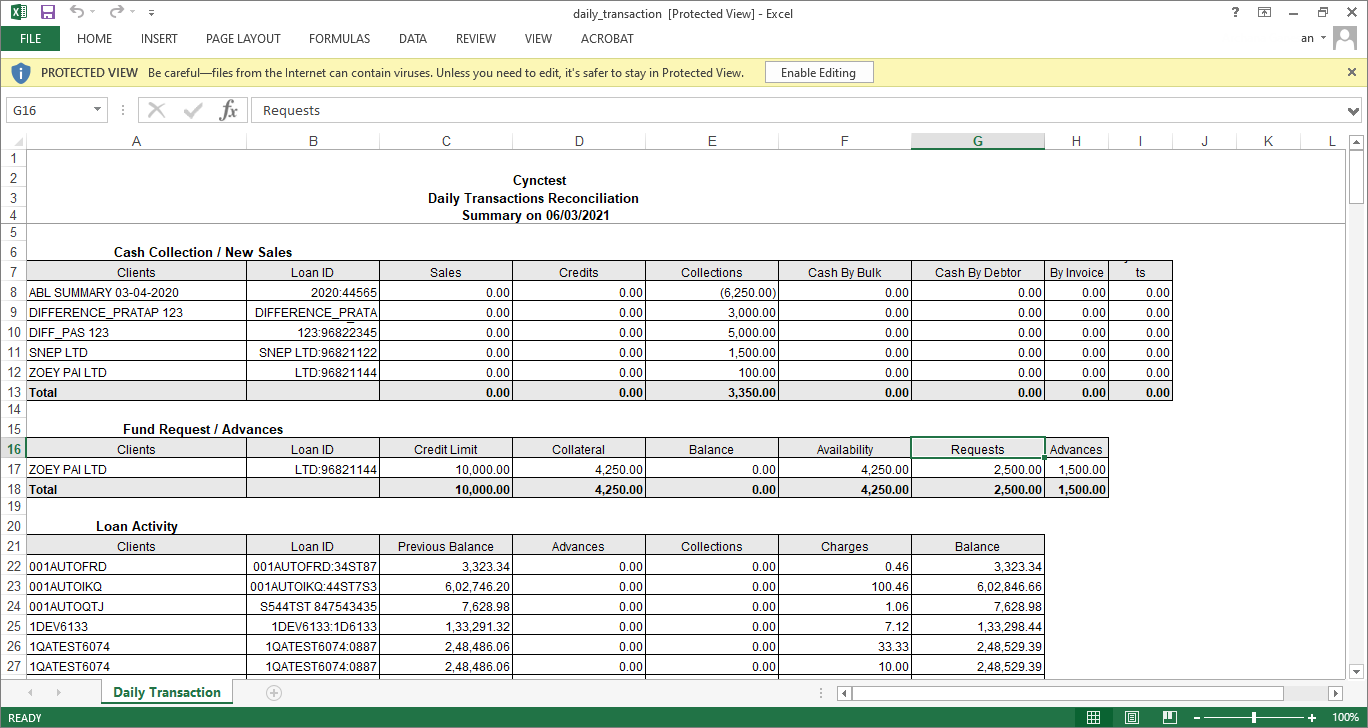

To extract the Daily Transactions Reconciliation report in Excel format, perform these steps:

1. Click the  icon in the generated Daily Transactions Reconciliation report. A popup message “Do you want to open or save Daily_Transactions_Reconciliation.xlsx from cyncsoftware.com” appears.

icon in the generated Daily Transactions Reconciliation report. A popup message “Do you want to open or save Daily_Transactions_Reconciliation.xlsx from cyncsoftware.com” appears.

2. Click Save if you want to save the report. (or)

3. Click Open if you want to open the report. The report is extracted in Excel format.

Refer to the screenshot:

The system displays the inactive clients in the Client field only if the Inactive Clients Summary is checked ON under the Roles and Permissions page for the specific role. The system will not display the inactive clients in the Client field if the Inactive Clients Summary is checked OFF under the Roles and Permissions page for the specific role.